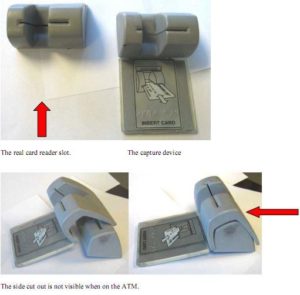

Well, it is possible that you fell victim to “skimming,” a method used by criminals to steal your card information and PIN. Skimmers are small devices retrofitted to a legitimate credit or debit card reader. Skimming occurs most frequently at places like restaurants, gas stations or ATMs. Once the information is captured, they can use it to make purchases or withdraw cash. And the real trick is that your card is never lost or stolen so it could go without being detected until a statement or overdraft notice arrives.

To prevent being a victim of credit card skimming, use these tips:

- Know what a credit card skimmer looks like. Check out this article that explains the differences between real and fake devices.

- Before you use an ATM or other card ready, make sure there aren’t any devices attached to it. Skimmers often place a camera within view of the keypad to steal your PIN. Or, they place a fake keypad on top of the real one to record your keystrokes. Everything should feel sturdy, as payment devices are designed to not break easily.

- When using an ATM, cover your hand as you type in your PIN. If there is a camera installed, doing this will help keep a camera from catching a view of what you’re typing.

There is no sure-fire way to avoid identity theft. It is important to monitor your accounts carefully. For peace of mind, consider our Identity Recovery and Fraud Reimbursement Coverage. Contact us today to learn more about how the plan works.